#3: Caitlin Craig Talks About Early-Career Risk Taking and Decision Making

For the next installment of this series I talked with Caitlin Craig, a founding member at UNPITCHD.

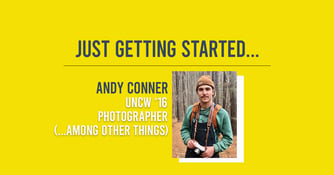

Welcome to the new Just Getting Started Series.

The goal of this series of articles is simple: talk to people early in their career to provide accessible advice for those just starting theirs.

Most content series I see focus on people who have already made it. The big wigs. It can feel a little inaccessible, so I wanted to start talking to people I know who are finding success early in their careers. That way, the advice feels relevant for the next generation of the workforce.

If you'd like to share your story, please contact me here.

For the first article, I emailed with a good friend of mine, Roman Hawkins. We both went to UNC - Wilmington from 2012-2016, lived together for a year from 2017-2018, and I always enjoy talking with him.

He's smart as hell and is focused in his career. He double majored in Finance and Economics, started his career as a Finance Operations Analyst at PPD, and now works for a startup called Apiture as a Manager in Financial Planning and Analysis.

Apiture just completed a $20 million fundraising round and is one of the budding companies in an eager startup scene in Wilmington, NC.

Roman is one of those people that you want to have in your corner. And as I go through my career and start to make a short-list of people I go to for advice on certain things, he's near the top.

So I wanted to understand where his interest in finance came from, what he learned in college that has applied to his career, and I was eager to get a clearer picture of the early career track of someone with his interests.

So let's jump into the interview.

What's an early career fuck-up of yours?

I can’t think of a distinct early career mistake, not saying that none were made; I think so many were made that a single mistake doesn't seem more significant than the other. Without mistakes, I wouldn’t have matured and progressed in my career. There's a quote that says, "If you look back and you’re not slightly embarrassed at who you were a year ago, then you aren't progressing." I resonate with that. I look back at my early career years and cringe at certain interactions and situations, but in the right lens, that's overall a good thing; it shows I’m growing personally and professionally, and I’m headed in the right direction.

Describe your role at Apiture in a couple of sentences.

I could go into paragraphs to answer this question, but to keep it short and sweet… My goal is to provide continuous financial transparency and guidance to our internal stakeholders and external shareholders while maximizing our company’s financial performance.

What does your leadership team look to you to provide?

The leadership team looks to me to be able to answer these four things — What happened? Why did it happen? What’s going to happen? And what can we do to change it (if needed)?

Overall, they rely on me to provide financial guidance and analysis. Guidance can come in many forms, whether it's planning, business cases, financial/economic models, or merely providing the proper communication for any unanticipated financial fluctuations. The analysis has been at the forefront of delivering overall transparency to our stakeholders. Our finance team has harnessed technology to provide real-time financial insights that would have taken 3x the human capital to standup a decade ago.

How do you know you're doing your job well?

That's a great question. Naturally, I first look for external validation from my peers and leadership, but that can be a short lived high. External validation is very rewarding to employees and I encourage my colleagues and work community to continue to give it more often if anything. Most importantly, I know when I’m doing my job well when I achieve and surpass the personal goals I’ve set. I think we all will achieve longer-lived satisfaction when we set personal goals and make effective strategies to come closer each day to reaching those objectives.

When did you (if ever) figure out you wanted to move into finance? Why did you want to?

As a kid, the idea of stocks fascinated me; the concept of buying a share of a company was so intriguing, and the fact they would even pay you to own that share (dividends) depending on the company was a no brainer to me. Numbers have always been more manageable than words for me, probably attributed to the fact that English is the second language I learned, but numbers are the same in every language. I wanted to venture into investment banking and capital markets as I entered college, but the idea of corporate finance became more attractive as I took more corporate finance-related courses and internships. It's not all spreadsheets and dashboards — going through investment rounds and M&A activity has been a great experience and very rewarding.

What was the most important thing you learned in college that has helped you today?

My (our) university pushed the importance of networking and selling yourself, which are both tremendous real-life skills to have. Know your worth and sell it like it no one else because at the end of the day no one else will.

Is there anything that you didn't learn that you'd recommend to a past Roman Hawkins to learn before entering the workforce?

Listen more, talk less. Emotional intelligence was something that was taught in college but didn’t become a reality until I was in the workforce. When your emotions take the driver seat, your opinion(s) might be discounted even if you have the valid backing to support your case.

How do you think people perceive a finance team at a company? Are there any myths that you think need debunking?

That probably varies by company depending on the talent and responsibilities of the department. The stereotypical response is that finance teams are always penny-pinching and looking out for the top and bottom line at all times. They might assume finance teams make decisions just based on the numbers, but there is a lot more than goes into it. Overall, I think everyone goes to finance to make sure we are working in our annual operating plan's confines and how we are tracking towards our fiscal year targets.

What's the general or ideal career track of someone in your field? Any advice for someone just starting their finance career?

Start early. Figure out where you want to work, whether it's a specific industry or company, do that via research by reading, talking to people who do your desired jobs, and shadowing those same people. Once you figure that out, get on the ground floor and absorb. It's equally important to figure out what you don't like as you do like. Get as much experience as you can, whether that's making cold calls or doing side-projects; always go the extra mile when people expect it least. The journey has a lot to give along the way to the destination.

As I was reading Roman's answers, it surprised me that I didn't know a lot of this about him.

So already, in the first article of a new series, I am stoked about the prospect of being able to uncover new things about the people in my network.

I think there are a few huge lessons here for folks early in their career:

Thanks for reading the first article of the series, and we'll be back soon. Thanks again to Roman for his time and advice here!

For the next installment of this series I talked with Caitlin Craig, a founding member at UNPITCHD.